Good morning. At last year's Jackson Hole symposium, I delivered a brief, direct message. My remarks this year will be a bit longer, but the message is the same: It is the Fed's job to bring inflation down to our 2 percent goal, and we will do so.

早上好。在去年的杰克逊霍尔研讨会上,我曾发表了一个简短而直接的讲话。我今年的演讲将稍长一些,但要传达的信息是一样的:将通胀降至2%的目标是美联储的职责,我们将致力于实现这一点。

We have tightened policy significantly over the past year. Although inflation has moved down from its peak—a welcome development—it remains too high. We are prepared to raise rates further if appropriate, and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.

在过去的一年里,我们极大地收紧了货币政策。尽管通胀率已经从最高点回落——这是一个可喜的发展——但仍然过高。我们准备在适当的情况下进一步提高利率,并打算将政策利率维持在一个限制性水平,直到我们确信通胀正在朝着我们的目标持续下降。

Today I will review our progress so far and discuss the outlook and the uncertainties we face as we pursue our dual mandate goals. I will conclude with a summary of what this means for policy. Given how far we have come, at upcoming meetings we are in a position to proceed carefully as we assess the incoming data and the evolving outlook and risks.

今天,我将回顾我们迄今为止所取得的进展,并讨论我们在追求双重使命时所面临的前景和不确定性。最后,我将总结一下这对政策意味着什么。考虑到我们已经取得的进展,在即将召开的会议上,我们能够在评估新进数据以及不断变化的前景和风险时谨慎行事。

迄今为止的通胀进展

The ongoing episode of high inflation initially emerged from a collision between very strong demand and pandemic-constrained supply. By the time the Federal Open Market Committee raised the policy rate in March 2022, it was clear that bringing down inflation would depend on both the unwinding of the unprecedented pandemic-related demand and supply distortions and on our tightening of monetary policy, which would slow the growth of aggregate demand, allowing supply time to catch up. While these two forces are now working together to bring down inflation, the process still has a long way to go, even with the more favorable recent readings.

持续的高通胀最初是由异常强劲的需求与受疫情限制的供给相撞应运而生的。截止2022年3月联邦公开市场委员会(FOMC)提高政策利率之时,很明显,降低通胀既取决于消除与疫情相关的前所未有的需求和供给扭曲,也取决于我们收紧货币政策,因为这将减缓总需求的增长,使供给有时间迎头赶上。虽然这两股力量目前正在共同努力降低通胀,但这一过程仍有很长的路要走,即使最近的数据颇为有利。

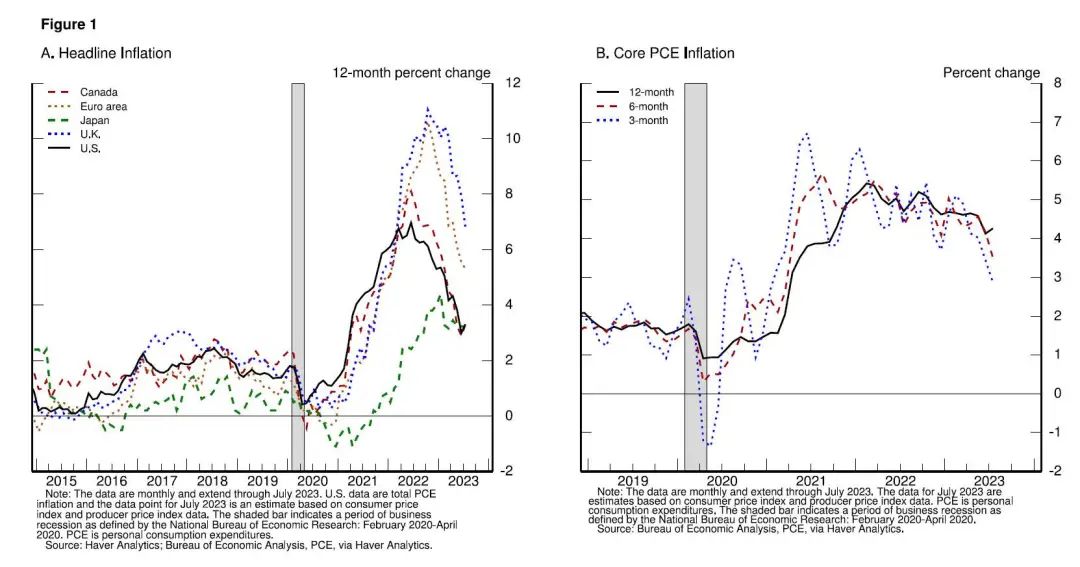

On a 12-month basis, U.S. total, or "headline," PCE (personal consumption expenditures) inflation peaked at 7 percent in June 2022 and declined to 3.3 percent as of July, following a trajectory roughly in line with global trends (figure 1, panel A). The effects of Russia's war against Ukraine have been a primary driver of the changes in headline inflation around the world since early 2022. Headline inflation is what households and businesses experience most directly, so this decline is very good news. But food and energy prices are influenced by global factors that remain volatile, and can provide a misleading signal of where inflation is headed. In my remaining comments, I will focus on core PCE inflation, which omits the food and energy components.

同比来看,美国总体个人消费支出(PCE)通胀率在2022年6月达到7%的峰值,并在今年7月降至3.3%,大致与全球趋势一致(图1,面板A)。自2022年初以来,俄乌冲突的影响一直是全球总体通胀变化的主要驱动因素。总体通胀是家庭和企业最能直接感受到的,因此这一降幅是个非常好的消息。但食品和能源价格受到全球因素的影响,而这些因素仍不稳定,并可能会对通胀走向发出误导性信号。在我剩下的演讲中,我将重点关注核心PCE通胀,其中剔除了食品和能源部分。

On a 12-month basis, core PCE inflation peaked at 5.4 percent in February 2022 and declined gradually to 4.3 percent in July (figure 1, panel B). The lower monthly readings for core inflation in June and July were welcome, but two months of good data are only the beginning of what it will take to build confidence that inflation is moving down sustainably toward our goal. We can't yet know the extent to which these lower readings will continue or where underlying inflation will settle over coming quarters. Twelve-month core inflation is still elevated, and there is substantial further ground to cover to get back to price stability.

同比来看,核心PCE通胀率在2022年2月达到5.4%的峰值,并在今年7月逐渐下降至4.3%(图1,面板B)。6月和7月的月度核心通胀数据较低无疑是受欢迎的,但这两个月的好数据只是建立对通胀向目标持续下行信心的开始。我们还不知道这些较低的数据会持续到什么程度,也不知道未来几个季度潜在的通胀会在哪里稳定下来。12个月(同比)核心通胀率仍处于高位,要恢复物价稳定还有相当长的路要走。

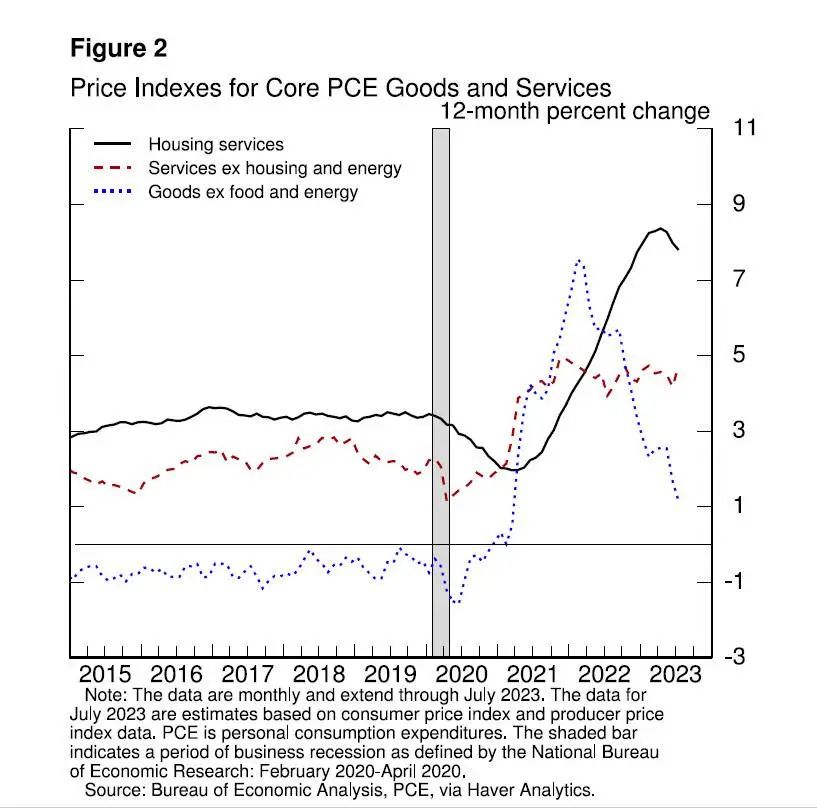

To understand the factors that will likely drive further progress, it is useful to separately examine the three broad components of core PCE inflation—inflation for goods, for housing services, and for all other services, sometimes referred to as nonhousing services (figure 2).

To understand the factors that will likely drive further progress, it is useful to separately examine the three broad components of core PCE inflation—inflation for goods, for housing services, and for all other services, sometimes referred to as nonhousing services (figure 2).

为了理解可能推动通胀进一步发展的因素,我们有必要分别考察核心PCE通胀的三个主要组成部分——商品通胀、住房服务通胀和所有其他服务通胀,有时被称为非住房服务业(图2)。

Core goods inflation has fallen sharply, particularly for durable goods, as both tighter monetary policy and the slow unwinding of supply and demand dislocations are bringing it down. The motor vehicle sector provides a good illustration. Earlier in the pandemic, demand for vehicles rose sharply, supported by low interest rates, fiscal transfers, curtailed spending on in-person services, and shifts in preference away from using public transportation and from living in cities. But because of a shortage of semiconductors, vehicle supply actually fell. Vehicle prices spiked, and a large pool of pent-up demand emerged. As the pandemic and its effects have waned, production and inventories have grown, and supply has improved. At the same time, higher interest rates have weighed on demand. Interest rates on auto loans have nearly doubled since early last year, and customers report feeling the effect of higher rates on affordability. On net, motor vehicle inflation has declined sharply because of the combined effects of these supply and demand factors.

核心商品(尤其是耐用品)通胀已大幅下降,因为货币政策收紧以及供需错位的缓慢缓解正在拉低核心商品通胀。汽车分项就是一个很好的例子。在疫情早期,由于低利率、财政转移支付、面对面服务支出减少,以及人们不再倾向于使用公共交通工具和居住在城市,对车辆的需求急剧上升。但由于半导体的短缺,汽车供给实际上下降了。因此,汽车价格飙升,大量被压抑的需求开始出现。随着疫情及其影响的减弱,生产和库存有所增加,供给相应改善。与此同时,更高的利率也抑制了需求。自去年初以来,汽车贷款利率几乎翻了一番。此外,消费者报告称,利率上升对他们的负担能力产生了影响。总的来说,由于这些供给和需求因素的综合影响,机动车辆的通胀率急剧下降。

Similar dynamics are playing out for core goods inflation overall. As they do, the effects of monetary restraint should show through more fully over time. Core goods prices fell the past two months, but on a 12-month basis, core goods inflation remains well above its pre-pandemic level. Sustained progress is needed, and restrictive monetary policy is called for to achieve that progress.

整体上看,核心商品通胀也呈现出类似的态势。随着时间的推移,货币政策紧缩的效果应该会更充分地显现出来。核心商品价格在过去两个月有所下降,但同比增速仍远高于大流行前的水平。持续的进展是必要的,为了实现这一进展,需要采取限制性货币政策。

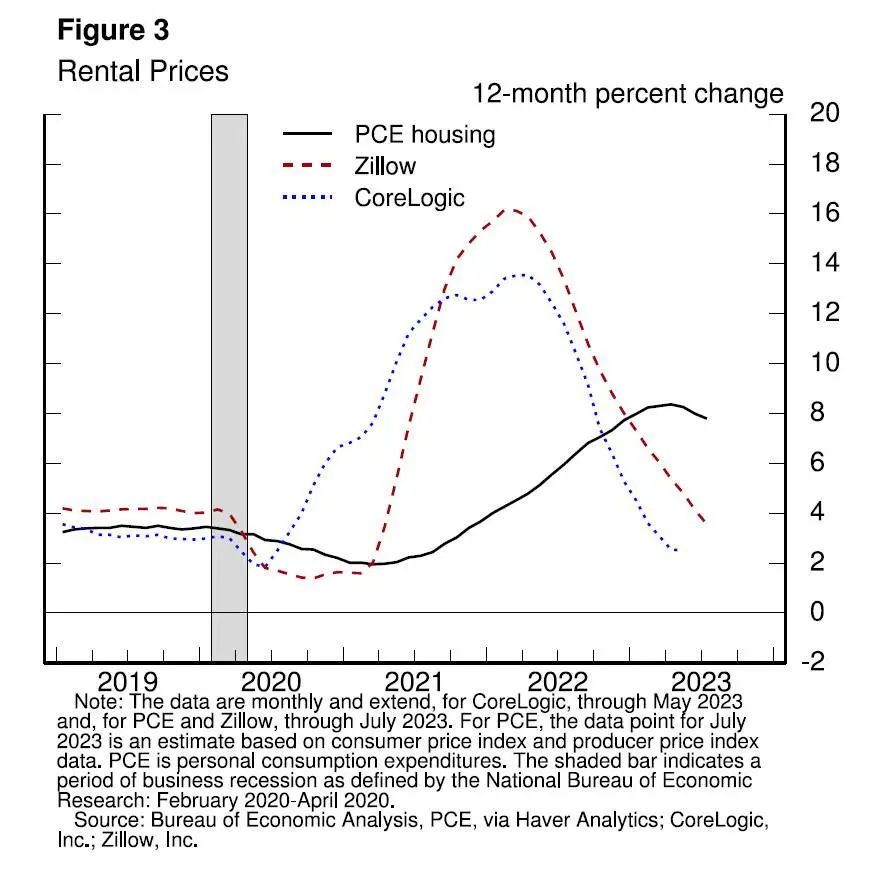

In the highly interest-sensitive housing sector, the effects of monetary policy became apparent soon after liftoff. Mortgage rates doubled over the course of 2022, causing housing starts and sales to fall and house price growth to plummet. Growth in market rents soon peaked and then steadily declined (figure 3).

在对利率高度敏感的房地产行业,货币政策的效果在加息不久之后就已显现出来。在2022年期间,抵押贷款利率翻了一番,导致房屋开工率和销售量下降,房价涨幅暴跌。市场租金的增长很快见顶,然后稳步下降(图3)。

Measured housing services inflation lagged these changes, as is typical, but has recently begun to fall. This inflation metric reflects rents paid by all tenants, as well as estimates of the equivalent rents that could be earned from homes that are owner occupied.4 Because leases turn over slowly, it takes time for a decline in market rent growth to work its way into the overall inflation measure. The market rent slowdown has only recently begun to show through to that measure. The slowing growth in rents for new leases over roughly the past year can be thought of as "in the pipeline" and will affect measured housing services inflation over the coming year. Going forward, if market rent growth settles near pre-pandemic levels, housing services inflation should decline toward its pre-pandemic level as well. We will continue to watch the market rent data closely for a signal of the upside and downside risks to housing services inflation.

PCE指数所衡量的住房服务通胀滞后于这些市场变化,但最近也开始下降。这一通胀指标反映了所有租户支付的租金,以及对自住房屋可能赚取的等效租金的估计。由于租约周转缓慢,市场租金增速的下降需要一段时间才能影响到整体通胀指标。市场租金放缓直到最近才开始体现在这一指标上。过去一年左右的新租金增长放缓可以被视为“正在酝酿中”,并将影响未来一年的住房服务通胀。展望未来,如果市场租金增长稳定在疫情前的水平附近,住房服务通胀也应该下降到疫情前的水平。我们将继续密切关注市场租金数据,以寻找住房服务通胀上行和下行风险的信号。

The final category, nonhousing services, accounts for over half of the core PCE index and includes a broad range of services, such as health care, food services, transportation, and accommodations. Twelve-month inflation in this sector has moved sideways since liftoff. Inflation measured over the past three and six months has declined, however, which is encouraging. Part of the reason for the modest decline of nonhousing services inflation so far is that many of these services were less affected by global supply chain bottlenecks and are generally thought to be less interest sensitive than other sectors such as housing or durable goods. Production of these services is also relatively labor intensive, and the labor market remains tight. Given the size of this sector, some further progress here will be essential to restoring price stability. Over time, restrictive monetary policy will help bring aggregate supply and demand back into better balance, reducing inflationary pressures in this key sector.

最后一大类,即非住房服务,占核心PCE的一半以上,包括各类广泛的服务业,如医疗保健,食品服务,交通和住宿。自加息以来,该分项的12个月(同比)通胀率一直在横盘。不过,过去3个月和6个月的通胀率有所下降,这令人鼓舞。迄今为止,非住房服务通胀仅温和下降的部分原因是,其中许多服务业受全球供应链瓶颈的影响较小,且通常被认为其对利率的敏感度并不像住房或耐用品一样大。这些服务的生产也是相对劳动密集型的,劳动力市场目前仍然紧俏。鉴于这一大项的规模,在这方面取得进一步进展对于恢复价格稳定至关重要。随着时间的推移,限制性货币政策将有助于使总供给和总需求恢复到更好的平衡状态,减少这一关键分项的通胀压力。

前景

Turning to the outlook, although further unwinding of pandemic-related distortions should continue to put some downward pressure on inflation, restrictive monetary policy will likely play an increasingly important role. Getting inflation sustainably back down to 2 percent is expected to require a period of below-trend economic growth as well as some softening in labor market conditions.

关于前景,虽然疫情相关的扭曲效应在逐渐消除的过程中将继续对通胀施加下行压力,但限制性的货币政策可能会发挥越来越重要的作用。预计需要经历一段经济增长低于趋势增长的时期,而且需要劳动力市场状况有所缓和,通胀才能持续地回落至2%。

经济增长

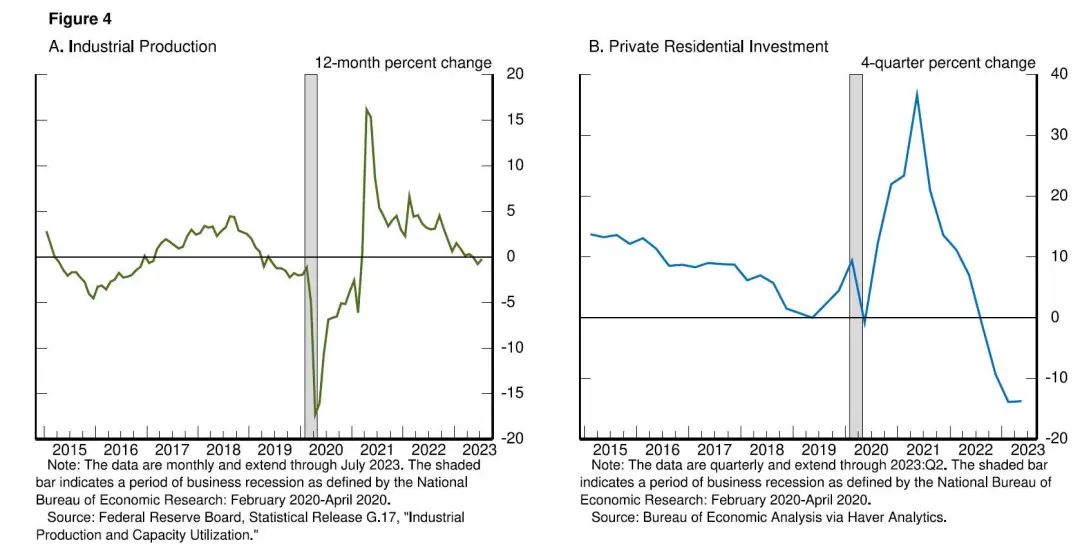

Restrictive monetary policy has tightened financial conditions, supporting the expectation of below-trend growth. Since last year's symposium, the two-year real yield is up about 250 basis points, and longer-term real yields are higher as well—by nearly 150 basis points. Beyond changes in interest rates, bank lending standards have tightened, and loan growth has slowed sharply. Such a tightening of broad financial conditions typically contributes to a slowing in the growth of economic activity, and there is evidence of that in this cycle as well. For example, growth in industrial production has slowed, and the amount spent on residential investment has declined in each of the past five quarters (figure 4).

限制性的货币政策收紧了金融状况,以支持对低于趋势增长的预期。自去年的杰克逊霍尔会议以来,两年期实际收益率上涨了约250个基点,而较长期的实际收益率也上升了近150个基点。除了利率变化外,银行的贷款标准有所收紧,贷款增长急速放缓。这种广泛的金融状况收紧通常会导致经济活动的增长放缓,在本轮周期也有这类证据。例如,在过去的五个季度中,工业产出的增长已然放缓,住宅投资支出也在下降(图4)。

But we are attentive to signs that the economy may not be cooling as expected. So far this year, GDP (gross domestic product) growth has come in above expectations and above its longer-run trend, and recent readings on consumer spending have been especially robust. In addition, after decelerating sharply over the past 18 months, the housing sector is showing signs of picking back up. Additional evidence of persistently above-trend growth could put further progress on inflation at risk and could warrant further tightening of monetary policy.

But we are attentive to signs that the economy may not be cooling as expected. So far this year, GDP (gross domestic product) growth has come in above expectations and above its longer-run trend, and recent readings on consumer spending have been especially robust. In addition, after decelerating sharply over the past 18 months, the housing sector is showing signs of picking back up. Additional evidence of persistently above-trend growth could put further progress on inflation at risk and could warrant further tightening of monetary policy.

但我们正密切关注那些未反映经济如期降温的信号。今年迄今为止,GDP(国内生产总值)增长超出预期,也高于其长期趋势,而且最近的消费支出数据尤为强劲。此外,地产行业在过去18个月里急速放缓之后正显示出复苏的迹象。持续高于趋势增长的进一步证据可能会使通胀前景面临风险,可能需要进一步收紧货币政策。

劳动力市场

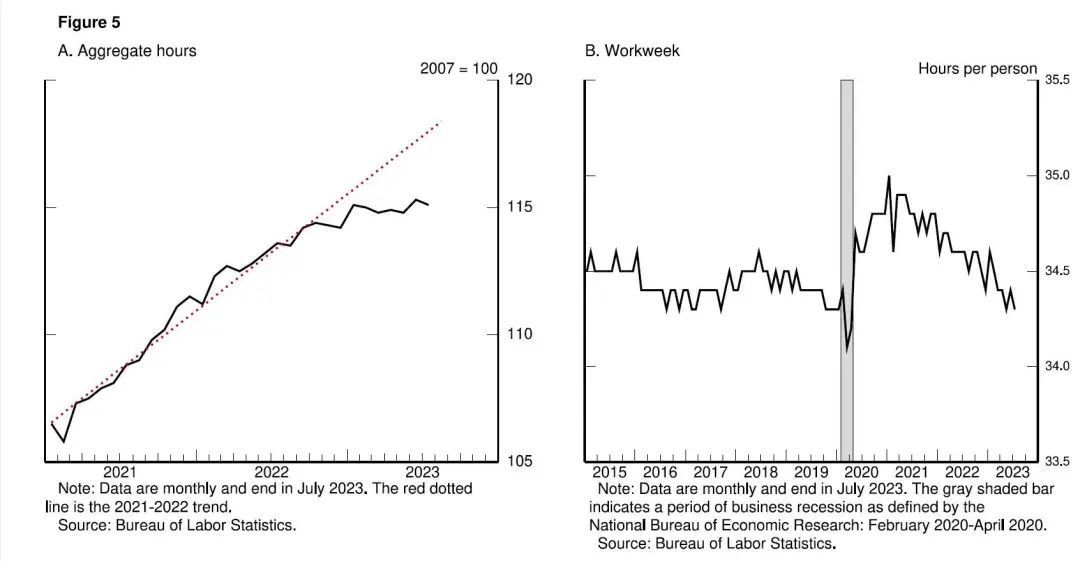

The rebalancing of the labor market has continued over the past year but remains incomplete. Labor supply has improved, driven by stronger participation among workers aged 25 to 54 and by an increase in immigration back toward pre-pandemic levels. Indeed, the labor force participation rate of women in their prime working years reached an all-time high in June. Demand for labor has moderated as well. Job openings remain high but are trending lower. Payroll job growth has slowed significantly. Total hours worked has been flat over the past six months, and the average workweek has declined to the lower end of its pre-pandemic range, reflecting a gradual normalization in labor market conditions (figure 5).

劳动力市场的再平衡在过去一年中持续进行,但仍未完成。劳动力供给有所改善,25-54岁的劳动力参与率有所增加,移民增速回升至疫情前水平。实际上,女性的壮龄劳动力参与率在6月达到了历史最高水平。对劳动力的需求也有所减缓。虽然职位空缺水平仍然很高,但其趋势在逐渐下降。就业岗位的增长已经显著放缓。过去六个月总工时保持稳定,平均周工作时长已下降至疫情前的区间下沿,反映出劳动力市场状况的逐渐正常化(图5)。

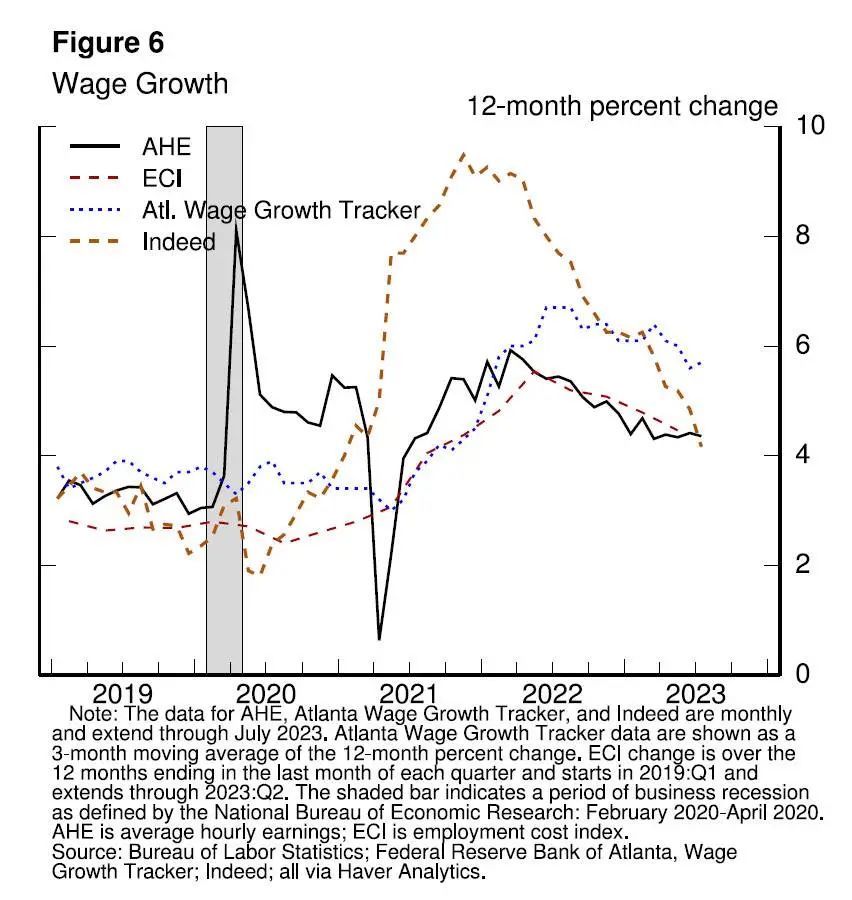

This rebalancing has eased wage pressures. Wage growth across a range of measures continues to slow, albeit gradually (figure 6). While nominal wage growth must ultimately slow to a rate that is consistent with 2 percent inflation, what matters for households is real wage growth. Even as nominal wage growth has slowed, real wage growth has been increasing as inflation has fallen.

This rebalancing has eased wage pressures. Wage growth across a range of measures continues to slow, albeit gradually (figure 6). While nominal wage growth must ultimately slow to a rate that is consistent with 2 percent inflation, what matters for households is real wage growth. Even as nominal wage growth has slowed, real wage growth has been increasing as inflation has fallen.

这种再平衡减轻了工资压力。从多个指标来看,工资增长仍在逐渐放缓(图6)。虽然名义工资增长最终必须放缓到与2%的通胀一致的水平,但对于家庭来说真实的工资增长才更重要。尽管名义工资增长放缓,但随着通胀下降,实际工资增长日益上升。

We expect this labor market rebalancing to continue. Evidence that the tightness in the labor market is no longer easing could also call for a monetary policy response.

We expect this labor market rebalancing to continue. Evidence that the tightness in the labor market is no longer easing could also call for a monetary policy response.

我们预计这种劳动力市场的再平衡将继续下去。如果证据表明劳动力市场的紧张状况不再持续缓解,仍有可能需要货币政策作出反应。

前路漫漫:不确定性与风险管理

Uncertainty and Risk Management along the Path Forward

2%依然是也仍将是我们的通胀目标。我们致力于实现与维持足够限制性的货币政策立场,以让通胀随着时间推移回到2%的水平。要实时判断这样的立场何时得以实现,当然极富挑战性。这当中的一些挑战,与历史上的所有紧缩周期具有共性。例如,实际利率目前已经转正,且远高于中性政策利率(r*)的主流估算。我们认为当前的政策立场是限制性的,对经济活动、劳工雇佣和通货膨胀均施加了下行压力。但我们没有能力明确指出中性利率的水平,也因此货币政策约束的精确水平总是存在不确定性。

Two percent is and will remain our inflation target. We are committed to achieving and sustaining a stance of monetary policy that is sufficiently restrictive to bring inflation down to that level over time. It is challenging, of course, to know in real time when such a stance has been achieved. There are some challenges that are common to all tightening cycles. For example, real interest rates are now positive and well above mainstream estimates of the neutral policy rate. We see the current stance of policy as restrictive, putting downward pressure on economic activity, hiring, and inflation. But we cannot identify with certainty the neutral rate of interest, and thus there is always uncertainty about the precise level of monetary policy restraint.

由于货币紧缩影响经济活动、尤其是通货膨胀的时滞长度的不确定性,对政策立场限制性的评估被进一步复杂化。自一年前的杰克逊霍尔会议以来,FOMC提高政策利率已达300bps,过去七个月当中加息100bps。我们还大幅削减了美联储的证券持仓规模。对这些时滞效应的估算区间甚广,也意味着进一步的显著拖累可能仍在传导当中。

That assessment is further complicated by uncertainty about the duration of the lags with which monetary tightening affects economic activity and especially inflation. Since the symposium a year ago, the Committee has raised the policy rate by 300 basis points, including 100 basis points over the past seven months. And we have substantially reduced the size of our securities holdings. The wide range of estimates of these lags suggests that there may be significant further drag in the pipeline.

在这些政策不确定性的传统来源之外,本轮周期当中独特的供需错配通过其对通货膨胀和劳动力市场动态的影响,为我们提出了更多难题。例如,截至目前,职位空缺已显著下滑,却没有造成失业增加——这一结果当然广受欢迎,但在历史上却是不寻常的,反映了对劳动力的严重过剩需求。此外,与过去数十年的经验相比,有证据表明通货膨胀对劳动力市场紧张的反应变得更加灵敏[8]。这些尚在变化中的动态也许会留存下来,也许不会,但不确定性本身强调了灵活政策制定的必要性。

[8] 劳动力市场松弛与通货膨胀之间的关系——常被称为菲利普斯曲线关系——可能是非线性的,在紧张的劳动力市场当中呈现陡峭化。如果菲利普斯曲线呈现这样的陡峭化,劳动力市场紧张程度的一点细微变化,就可能引致通货膨胀更为显著的变化。要实时精确地判断这种陡峭化的程度,或者伴随劳动力市场紧张程度的变化它会如何演变,是非常困难的。

Beyond these traditional sources of policy uncertainty, the supply and demand dislocations unique to this cycle raise further complications through their effects on inflation and labor market dynamics. For example, so far, job openings have declined substantially without increasing unemployment—a highly welcome but historically unusual result that appears to reflect large excess demand for labor. In addition, there is evidence that inflation has become more responsive to labor market tightness than was the case in recent decades.8 These changing dynamics may or may not persist, and this uncertainty underscores the need for agile policymaking.

8. The relationship between labor market slack and inflation, often called the Phillips curve relationship, is likely nonlinear, steepening in a tight labor market. If the Phillips curve has steepened in this way, a small change in labor market tightness could result in a more substantial change in inflation. It is difficult to know with precision how steep that relationship is in real time or how it might evolve as labor market tightness changes.

这些或熟悉或陌生的不确定性,给我们在货币政策过度紧缩的风险与紧缩力度不足的风险之间找到平衡的工作提出了难题。紧缩力度不足会让高于目标水平的通胀积重难返,最终货币政策为从经济当中祓除更为顽固的通胀,要在就业方面付出更高昂的代价。过度紧缩会对经济造成不必要的伤害。

These uncertainties, both old and new, complicate our task of balancing the risk of tightening monetary policy too much against the risk of tightening too little. Doing too little could allow above-target inflation to become entrenched and ultimately require monetary policy to wring more persistent inflation from the economy at a high cost to employment. Doing too much could also do unnecessary harm to the economy.

总结

就像大多数时候那样,我们在乌云密布的天空下寻星导航。在这样的情况下,风险管理方面的考量极为关键。在接下来的FOMC会议上,我们会基于所有数据和不断演变的前景与风险,对我们的进展做出评估。基于这一评估,我们会在决定是进一步紧缩还是维持政策利率不变等待更多数据出炉上谨慎行事。恢复价格稳定对于不折不扣地实现我们的双重使命而言至关重要。我们需要价格稳定,以实现持续一段时间的强劲劳动力市场状况,从而造福所有人。

As is often the case, we are navigating by the stars under cloudy skies. In such circumstances, risk-management considerations are critical. At upcoming meetings, we will assess our progress based on the totality of the data and the evolving outlook and risks. Based on this assessment, we will proceed carefully as we decide whether to tighten further or, instead, to hold the policy rate constant and await further data. Restoring price stability is essential to achieving both sides of our dual mandate. We will need price stability to achieve a sustained period of strong labor market conditions that benefit all.

不到大功告成之时,我们不会罢休。

We will keep at it until the job is done.